Finding Compound Interest,compound interest tables

Introduction

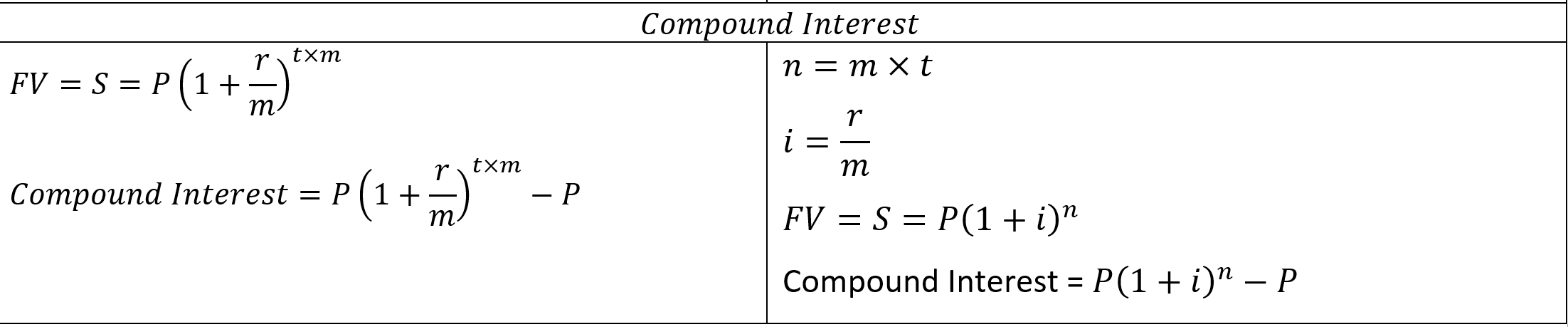

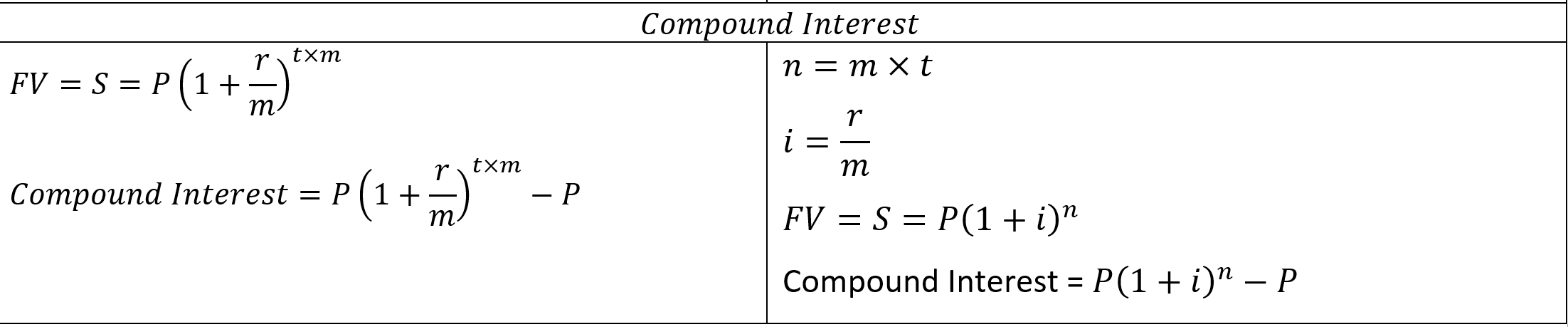

The following formula are used to compute compound interest manually:

Example:

Sami promised his daughter alice that he would give her $8,000 8 years from today for graduating from high school.

Assume money is worth 6% interest compounded semiannually.

Question: What is the present value of this $8,000?

Answer: Using the formula above; where m = 2 (semiannually); t = 8 years; n = m × t = 16 periods; i = 6 / 2 = 0.03; (1+0.03)16=1.6047

FV = S = P (1 + i)n = $8,000. Hence P = $8,000 / 1.6047 = $4,985.35

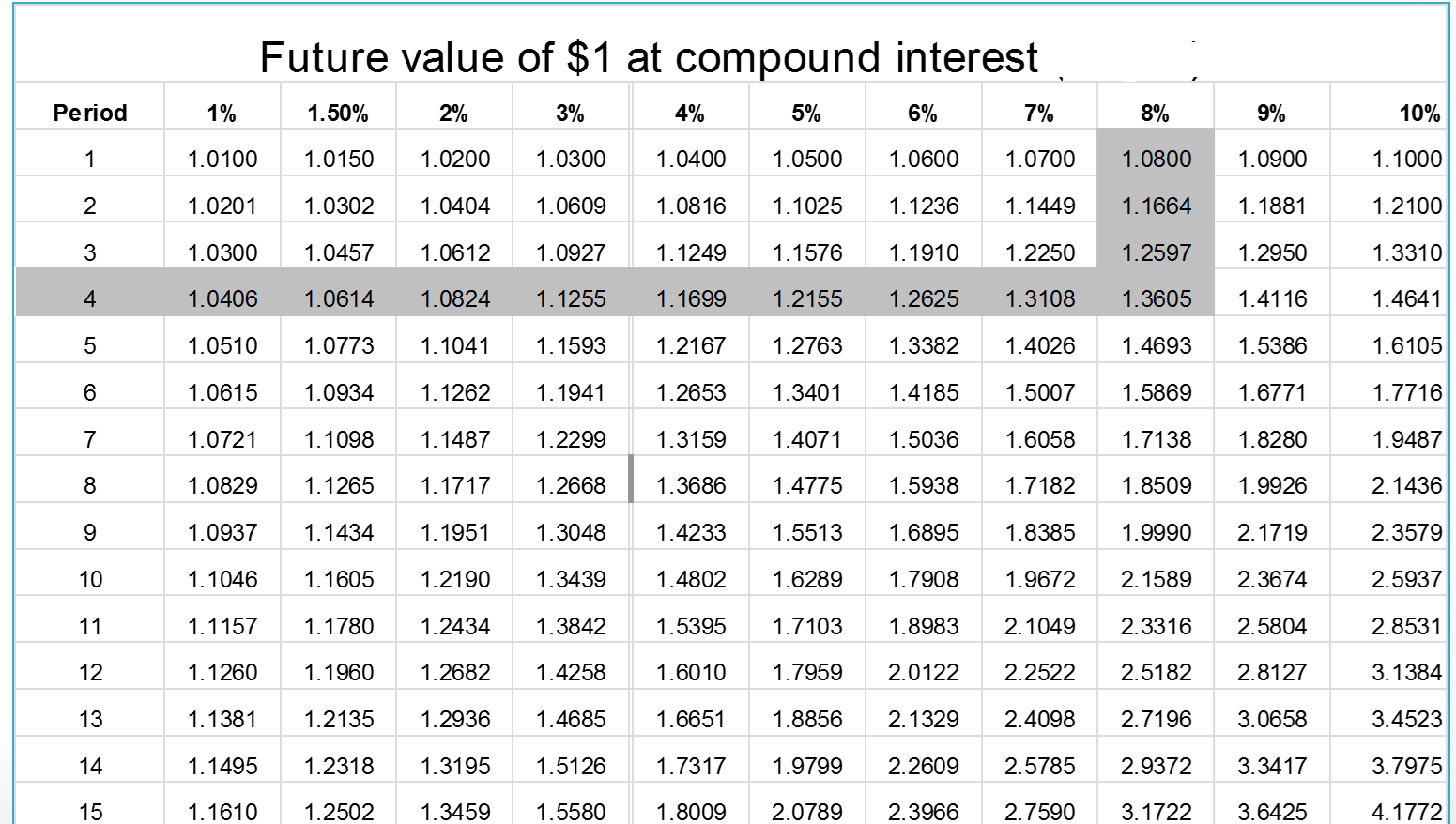

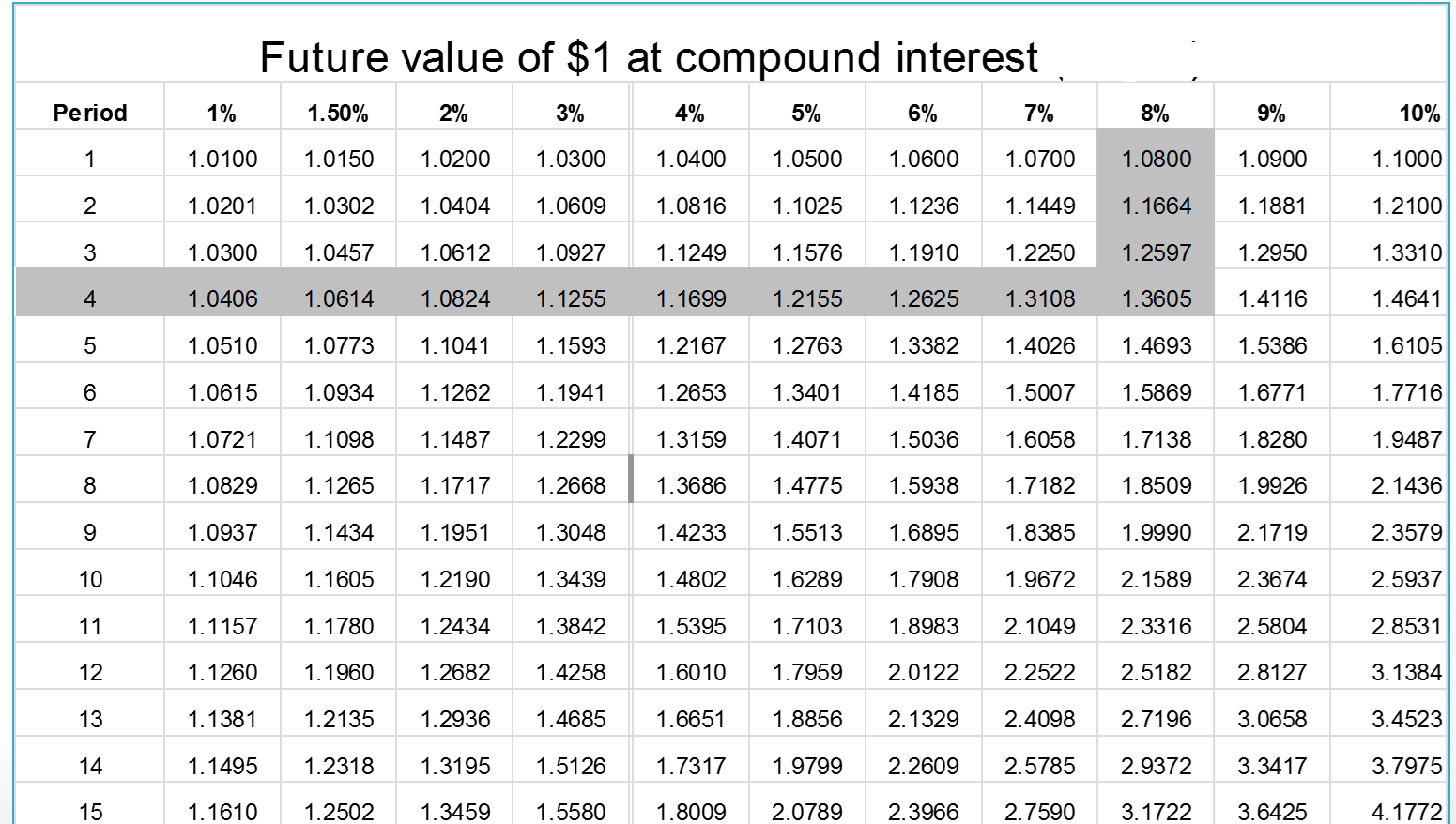

Calculating Compounded Amount by Table Lookup

Table lookup is another method for calculating the compounded amount. The steps are as follows:

- Find the periods: Years multiplied by number of times interest is compounded in 1 year.

- Find the rate: Annual rate divided by number of times interest is compounded in 1 year.

- Go down the period column of the table to the number desired; look across the row to find the rate.

At the intersection is the table factor for the compound amount of $1.

- Multiply the table factor by the original amount. This gives the compound amount.

For example, the future Value of $1 for 4 years at 8%. The Compound Interest is found as highlighted in the table below:

Exercise:

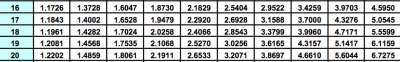

Assume that Mike deposits $5,000 in his savings account that pays 8% interest compounded quarterly.

Question: What will be the balance of his account at the end of 7 years?

Answer:

Periods (N) = 4 x 7 = 28; Rate (R) = 8% / 4 = 2%; Table Factor = 1.71

Compounded Amount = $5,000 x 1.7138 = $8,569.00;

Exercises and solutions

Exercise 1: Paul, owner of a car rental company, loaned $50,000 to Mike to help him open a startup.

Mike plans to repay Paul at the end of 6 years with 8% interest compounded semiannually.

Question: How much will Paul receive at the end of 6 years?

Answer:

N = 6 years x 2 = 12 periods; rate = 8% / 2 = 4%; Table factor = 1.6010;

Compounded amount = $50,000 × 1.6010 = $80,050; Paul will receive after 6 years $80,050

Exercise 2:

Mary Indecision has difficulty deciding whether to put his savings in ABC Bank or Seasons Bank.

ABC offers 8% interest compounded semiannually. Seasons offers 4% interest compounded quarterly.

Mary has $20,000 to invest. She expects to withdraw the money at the end of 5 years.

Question: Which bank should Mary choose?

Answer:

ABC Bank:

N = 5 years x 2 = 10 periods; rate = 8% / 2 = 4%; Table factor (10 periods, 4%) = 1.4802;

Compounded amount = $20,000 × 1.4802 = $29,604; So at the end of 5 years the addtional amount = $29,604 − $20,000 = $9,604

Seasons Bank:

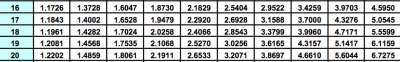

N = 5 years x 4 = 20 periods; rate = % / 2 = 2%; Table factor (20 periods, 2%) = 1.4849;

Compounded amount = $20,000 × 1.4849 = $29,698; So at the end of 5 years the addtional amount = $29,698 − $20,000 = $9,698

Seasons has a slightly better deal than ABC.

Exercise 3:

Bob deposited $25,000 in a new savings account at 6% interest compounded semiannually.

At the beginning of year 3, Bob deposits an additional $35,000 at 8% interest compounded semiannually.

At the end of 4 years, what is the balance in Bob's account?

Answer:

N = 2 years × 2 = 4 periods; rate = 8% / 2 = 4%; table factor (4 periods, 4%) = 1.1699; after 2 years compounded amount = $25,000 × 1.1699 = $29,247.5

At the beginning of year 3, Bob deposited additional $35,000. So the new amount in his account would be = $35,000 + $29,247.5 = $64,247.5

At the end of 4 years, the new compounded amount would be = $64,247.5 × 1.1699 = $75,163.15

Exercise 4:

Mary deposits $6,000 into an account earning 4% annually.

After 8 years what will Mary's balance have grown to, including interest?

Answer:

N= 8 years × 1 = 8 periods; rate = 4 / 1 = 4%; table factor (8 periods, 4%) = 1.3686;

Compounded amound = $6,000 x 1.3686 = $8,211.60

Learning Further details on Calculating Present Value is available through the link.

For more details, please contact me here.